Fine, solution me genuinely: how often have you discovered yourself maxing out a charge card, simply to change and use for another? All also frequently, when people who have a problem with finding that ‘insufficient funds’ warning once they hit down that credit card for a purchase, they just get another card. Instead of facing the very fact that they have a credit card issue, they only maximum out yet another card.Well, if that describes you, consider the choice of placing all of those maxed out cards onto one card by acquiring a stability move card. Frequently, you can make the most of lower curiosity charges and costs, plus experience other characteristics, such as for example being waived for the annual cost when you pay your statement consistently every month.When obtaining a balance move charge card, you can breathe a little simpler in regards to monitoring those different cards that have been maxed out, as well as the monthly bills on each card that turns up throughout the month. There might be some reassurance comprehending that you just have one credit card statement showing up every month to address.Banks and financing institutions are also aware of the paying habits of several persons nowadays and that their inclination could be to maximum out the restrict of these credit cards. This is the top reason stability move cards are so common to start with and why they are so available. Therefore, how do you get one of these brilliant stability transfer cards?

In a nutshell, first guarantee that the fascination charge is better than the main one on your overall cards. Or even, it won’t be worth your time and effort, mainly because you intend to save yourself money in curiosity prices in addition to merge your credit card debt. After deciding that to function as the event, whenever you sign up for a balance move card, you are provided the option of moving all your other credit cards to the newest balance move card. Usually these stability presents secure you in to a lowered, set rate for a time period; frequently six to twelve months. What a great deal, proper? Therefore, the following question you may well be thinking about is: why do they make these harmony move cards accessible?The answer really is easy and comes down to one term: competition! You’ll find so many credit businesses around and they are all competing for your business. They may well be finding you down the catch by giving you a diminished charge and a chance to move your entire charge card balances, but they’re also betting that you will remain with them and which will earn them your cash!

That said, make sure you go into that deal along with your eyes broad open. Or even, you can change that chance to consolidate all of your charge card debt right into a trap. It is imperative to indicate that, by using that possibility, it doesn’t give you certificate to keep on paying like there’s number tomorrow. All things considered, that is what got you to this point in the very first place, and you don’t wish to get backward, proper?Keep in mind that, to be able to take whole benefit of any stability move card, you’ve to use it as something to turn that bank card vessel around. Purpose being, any new balance transfer card can feature a time restrict on the lower curiosity rate and, if you keep maxing out that card, your minimal fascination rate will device and you will end up worse off than before in curiosity expenses and charges. Must this happen, you’ll never escape credit card jail!

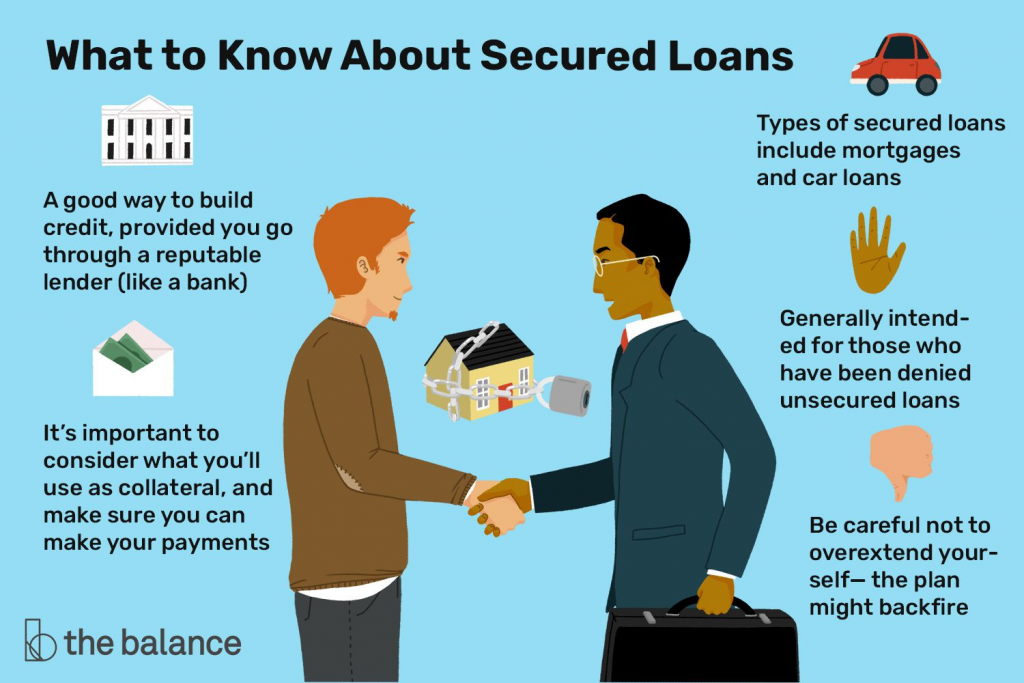

Can be your credit really bad or you just can’t get approved for a credit card? Then the secured bank card may be a good begin for you. This sort of card requires a deposit of income placed on the card with an accessible spending balance. The deposit obtains it and guarantees that the amount of money is there. Whether you’re hoping to get a new card or have bad credit and require to begin fresh, you can find benefits to obtaining a secured card.It has become tougher to get charge cards these days. You may well be also young and haven’t any credit record, or simply your credit is merely bad. Luckily, you will find banks and different financial institutions that will provide you with a guaranteed card. A deposit is needed on your bill before it is released to you and produced active. Most banks require a deposit of somewhere between $150 and $300. This simply shields the institution from loaning you income and losing it. Your credit limit in your protected card is going to be everything you deposit; however, you can find banks that will include a hundred or so pounds or even fit your deposit.

Secure credit cards may also be being employed by many companies that have personnel who work lots of tasks and need business money to buy products for the office. Protected credit cards really are a excellent place to keep the cash and never having to provide personnel difficult cash. Several secure cards also generate factors as you employ them.The primary advantageous asset of these types of cards is that you can’t go over your limit and that you get a handle on said limit. Further, these cards are accepted everywhere and nobody contact tell that they are secured. Also, banks record your payments and harmony to the important bureaus, subsequently supporting your credit. Once you’ve been with a bank for around a year with a secured bank card and in excellent position, many will offer you an unsecured credit card.

It is essential to search around for a good, protected card. Your absolute best choice is to get hold of your bank and see what it needs to offer. Watch for large curiosity charges, as some demand more than 30%. Also, several banks want or need a regular annual charge to keep the card active. You shouldn’t spend an annual payment for a card on which you need certainly to deposit money.Getting a attached bank card might not be for everyone. It is a good way to start establishing credit if you are small and trying showing responsibility to a bank. If your credit is bad, then getting one of these cards is an ideal way to get your report going back up and to exhibit a bank you are capable of managing a credit card. Finished to consider when looking for a protected card is to look for one with a reduced interest charge that will not charge an annual fee. Most of all, when you have the card it’s wise to be responsible with it and treat it as if it were unsecured and you will have a way to create your credit ranking quickly.Isn’t it terrific to be economically protected? Having never to worry about income and different money problems? All big and small companies about the world invest 50% of their amount of time in raising revenues and gains and the others in being concerned about their security and security. From small company companies to big ones, each is seeking to find the wonderful bird called “income security.”

Everyone else features a different principle of the financial security. For some, having countless pounds savings is the answer while for the others it’s much less. But defining economic security in terms of guaranteed bank harmony, home and credit is not the right answer because it would cause most of us in believing it’s out of our reach. Nevertheless, these exact things do provide you with a sense of being economically powerful but does not actually resolve the problem of being financial guaranteed!!

Economic protection is obtainable for not only a few but also for securespend ; all you need is always to clearly realize and recognize the real degree of economic security.

What precisely does economic security suggest to businesses and how it can be reached? Every company makes gains, whether just about, that is why it’s still surviving in the market. This is where in actuality the preparing for financial protection has focus. The key to sustaining your expenses in such a way that they give maximum profits in minimal costs is the important thing to securing your financial position.Companies which have been affected by the existing Worldwide financial situation, particularly in America, are seriously searching methods to get greater solutions to lessen their working costs. Many of these businesses are start to consider outsourcing money and sales companies as a successful method of chopping costs and obtaining financial security.

What does outsourcing have to do with dilemmas regarding financial safety? Properly, Outsourcing your accounting responsibilities may possibly not merely help you save from the worries of continuous transaction upgrades, hiring costly sales and IT specialists, big company place, and different sales pc software and machines but also assists you in having included accountability and transparency in a lot more paid off prices! Applying outsourced sales companies may assist you to save your self a large amount of your expenses. Just the savings on payroll fees and benefits alone are tremendous.A badly-handled sales division may cause severe injury to the economic situation of a company. Subsequently it’s clear why several organization homeowners choose to shift this boring burden to the outsourcer, therefore developing economic protection when it comes to reduced costs.

If you intend your accounting function in the right way, economic security will remain close-by while economic disaster will remain far-off from you and your business. You can plan your money in your unique way nevertheless the advice of a financial sales manager is significantly more productive.Financial protection is within the achieve of everyone having a need to boost their financial condition, whether it’s a person or even a business. All it needs a little bit of discipline. If you should be among the seekers, look number further. You can find organizations to provide you complete array of economic and sales planning along side money administration services. But sure, most important of is to find the right one for you personally, as an example you will find top accounting firms in Virginia or best accounting firms in Virginia by visiting them online and having a review of their work they did as sales services for startups in Virginia or for corporate segment there.